Attention all Technology Dependent Businesses with 25 – 150 computers: Are you ready for business and security-focused IT support that will finally rid you of frustrating IT problems, protect what you worked so hard for from cyber-threats, increase profits and generate more business? You’re on the right website.

Toronto IT Consulting & Toronto IT Solutions Company

Technical Action Group, a Toronto Managed IT Services company, exists to Empower the business growth of technology-dependent businesses with 20 to 150 computers. Let TAG help YOUR business plan how to use technology to increase productivity, cut costs, gain competitive advantages, support your company’s growth, and keep the Cyber Criminals from taking what you worked so hard to build.

OUR PROVEN 4 STEP PROCESS

PLAN IT

PREVENT IT

SECURE IT

FIX IT

We offer a complete suite of

Managed IT solutions

MANAGED IT SERVICES

When resources are already limited, you don’t have time to manage computer problems or even micro-manage an external IT support provider. Let our Toronto IT consulting team take care of the A-Z required to proactively keep your IT assets humming, reliable, and secure. When you need help, our friendly, professional technicians are just a phone call or email away.

CLOUD COMPUTING

Reap the benefits of using leading-edge applications, with the flexibility and cost-effectiveness of scaling user licenses up and down to meet your changing needs.

NETWORK SECURITY

Now, more than ever, you need to rely on IT Solutions & Toronto IT Support expert advice and experience to help you keep the Cyber Criminals at bay.

BACKUP & DISASTER RECOVERY

Your data is the bloodline of your business. Sleep easier at night knowing it’s all being backed up regularly, and tested by us to ensure they run. And that your business can get back up again quickly, from anywhere, in the event of a disaster.

MAC SUPPORT

MACs are no longer just used by graphic designers. More and more businesses in various industries are introducing MACs into their environments. TAG has the expertise for your MAC needs.

PHONE SYSTEMS

A cloud phone system / VoIP offers functionality and flexibility that many businesses aren’t even aware of. Allow us to shed the light for you.

NETWORK INSTALLATIONS & UPGRADES

Carefully planned to meet your specific needs. Executed by a senior team with long track records of successful, on-time, and on-budget network installations and upgrades.

CUSTOM PROJECTS

TAG will help you budget, plan, manage and execute IT projects that are necessary for the continued growth, security, and reliability of your IT infrastructure.

CIO

We love being considered a valued partner in our clients success. Through regularly scheduled IT Review Meetings, and personalized IT Road Maps, allow us to provide you with the leadership necessary to give you a leg up on your competitors, plan for upcoming IT expenditures, and help you meet your business objectives for the next 3 – 5 years.

Flexible End User IT Support & Infrastructure Management

TAG’s computer support and managed IT services for Toronto businesses give you the freedom to focus on your core business. Benefit from our technical and business expertise that will keep your systems running smoothly, your data protected, increase your protection against cyber-threats, and implement a disaster recovery plan, all while your team remains effective, efficient, and profitable.

TAG is an Toronto IT consulting & support company of sufficient size and expertise to handle all of your technology needs, and intimate enough to give you the individual attention you deserve.

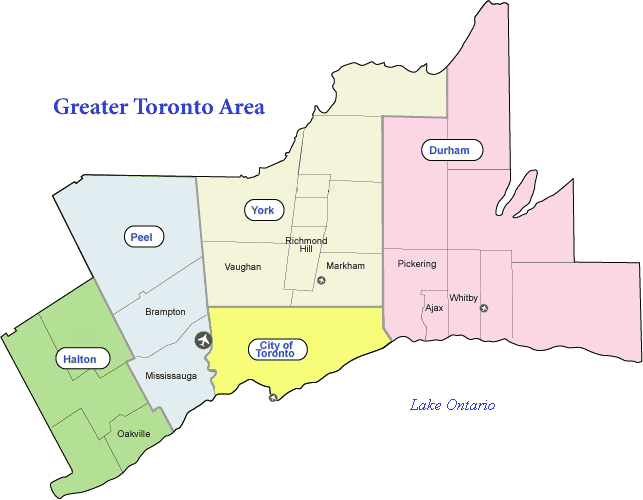

IT Support & IT Consulting Service Areas in the Greater Toronto Area

Technical Action Group, Toronto IT Solutions office is located steps away from the #1 Food Market In the World – St. Lawrence Market near Front & Church Street. Though we are in downtown Toronto, we seamlessly and efficiently serve 50+ clients throughout the GTA, Canada, and the USA thanks to our industry-leading remote management tools that enable us to resolve 95% of support remotely. This results in less waiting time, and more cost-efficient service to our clients. Contact our IT Consulting Toronto firm today!

Technical Action Group has been proudly serving businesses

in the following areas since 2003:

Our Latest IT Support Blog

Insider Secrets To

Hassle Free IT Support

Get your hands on a FREE copy of this revealing book to learn everything your I.T. guys never told you about how to use technology to make your small to medium-sized IT solutions Toronto business easier, more secure & more profitable.

Read this book and discover:

- The 5 types of technical support available and the pros and cons of each

- 5 critical facts you must know before moving to the cloud

- 12 warning signs that you hired the wrong computer consultant

- How to avoid getting ripped off, disappointed, or paying for sub-standard work

- How to turn technology into a competitive advantage instead of a drain on your time, money, and resources

- ….And much more!

See what other business owners

are saying about us...

5 Step Technology Support Process

Our 5-Step Technology Support Process as been the cornerstone of everything we do and was developed to ensure that clients get only what they need, and ask for, every time.

The President and all of TAG’s Help Desk Technicians follow this process in everything they do whether it’s as straightforward as installation of a new software application, or a more complex initiative like migration of an entire network.

UNDERSTANDING

YOUR NEEDS

ASSESSMENT

SOLUTION

PROPOSAL

PLANNING AND

IMPLEMENTATION

EVALUATION AND

MONITORING

GET IN TOUCH

Fill out the form and we’ll be in touch to review your network

FAQ'S

What are IT consulting services?

IT consulting Toronto involves a set of specialized services offered by IT professionals and consultants with the primary goal of helping organizations leverage technology to reach their business objectives. It involves a wide range of services, including assessing and analyzing the company’s current IT infrastructure and system, developing IT plans and strategies for the business, implementing technology solutions, designing and implementing, developing custom software, offering on-support, providing security, etc.